Intelligent Automation in Banking

Intelligent automation (IA) or Robotic process automation (RPA) is a comparatively new machine learning topic that is rapidly gaining prominence. It states to the usage of software robots or other cybernetic helpers that have been designed to do repetitive and time-consuming tasks.

Worldwide banks spend 6 -10% of their on compliance costs. Financial Industry spends $181B annually to maintain financial crime compliance. Since 2008 U.S banks are fined $243B due to non-compliance. IA can help a lot to decrease such fines and costs in Banking.

Robotics is defined in banking and finance to:

- Decrease human intervention.

- Improve process as per federal regulations.

- Create a virtual assistant of artificial intelligence.

Fig 1

In the banking business, RPA is a beneficial implement for addressing the banking sector’s (showing in Fig 1), persistent strains and assisting them in exploiting their efficiency via decreasing costs through the services concluded software paradigm. According to recent research, the financial services RPA business will be rate a stunning $2.9 billion in 2022, a huge rise beginning $250 million in 2016 [1].

Banking Automation’s Power

Robotic process automation may be used by banks and finance organizations to lessen human labor, upsurge acquiescence, condense risk, besides progress the overall client involvement. Moreover, since no extra setup is obligatory, the low-code technique styles automation suitable for banks besides financial foundations. In the banking industry, RPA’s main purpose is to help with the processing of repeated banking procedures. RPA benefits banks and financial foundations rise productivity by fetching clients in real-time then taking use of robots’ for various benefits [2].

RPA is a complex process that involves substantial personnel training, organized inputs, and oversight. If set of connections and employed appropriately, these RPA-constructed banking robots may assume comprehensive control of the system actions, including ticking then starting programs, sending emails, and copying and thrashing information after one financial system to alternative [3].

RPA benefiting the Banking sectors

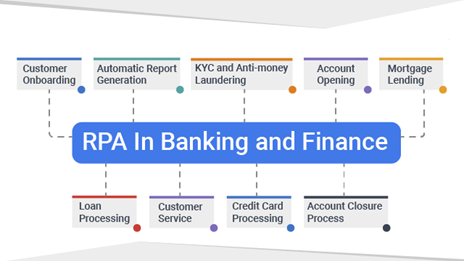

[Figure 2] depicts a number of distinct uses in this sector. Since then, RPA has been applied to a variety of business process automation ventures. We’ll go through a few of the advantages here:

Fig 2

1. Reports are generated automatically

Suspicious activity reports, or SARs, are needed for banks and financial institutions to create compliance reports for fraudulent activities. Nonetheless, it’s a tedious procedure that takes a long time and effort to finish. RPA technology can trawl through this extensive compliance paperwork with natural language producing skills before extracting the essential data and submitting the SAR [4].

2. On-boarding of new customers

In banks, customer on-boarding is a lengthy and drawn-out procedure. Several papers, in particular, need manual authentication. RPA can style the procedure informal by using optical character recognition to gather data from KYC documents. This data may formerly be compared to the data on condition that, by the client on the system. RPA automation in client on-boarding not solitary reduces manual mistakes but also hoards time as well as fortitude for employees.

3. Anti-Money Laundering (AML) and Know Your Customer (KYC)

KYC besides AML are both tremendously data-concentrated procedures, making them perfect RPA candidates. When equated to outmoded banking resolutions, RPA adoption has proved to be helpful in terms of convertible together time and money, whether it’s automating regular operations or recognizing questionable financial transactions.

4. Opening a bank account

The normally time-consuming process of creating a new account is made considerably easier, faster, and more precise with RPA. Automation eliminates data record faults that occur amid the main banking organization as well as new account opening requirements, boosting the information quality of the inclusive arrangement.

5. Lending for mortgages

One of the most significant services provided by a financial organization is lending. Mortgage lending is an ideal candidate for RPA automation since it is a highly process-driven and time-consuming industry. RPA expertise may be utilized to handle processes with explicitly defined rules with ease.

6. Loan Process

Traditionally, loan processing has been viewed as a time-consuming and wasteful process [5]. Despite the fact that the bank has computerized the procedure to some level, RPA has sped it up even more, bringing the processing time down to a new low of 10-15 minutes.

References :

1. Kumar, K. N., & Balaramachandran, P. R. (2018). Robotic process automation-a study of the impact on customer experience in retail banking industry. Journal of Internet Banking and Commerce, 23(3), 1-27.

2. Valgaeren, H. (2019). Robotic Process Automation in Financial and Accounting Processes in the Banking Sector.

3. Romao, M., Costa, J., & Costa, C. J. (2019, June). Robotic process automation: A case study in the banking industry. In 2019 14th Iberian Conference on information systems and technologies (CISTI) (pp. 1-6). IEEE.

4. Vishnu, S., Agochiya, V., & Palkar, R. (2017). Data-centered dependencies and opportunities for robotics process automation in banking. Journal of Financial Transformation, 45(1), 68-76.

5. Devarajan, Y. (2018). A study of robotic process automation use cases today for tomorrow’s business. International Journal of Computer Techniques, 5(6), 12-18.